Investing in REITs vs. Direct Real Estate

We navigate the pros and cons of real estate investment options.

Despite the volatility and uncertainty of the housing market over the past three years, real estate remains a valuable part of an investor’s portfolio.

Potential owners are understandably left uneasy as mortgage rates are sharply higher and home prices have slowly declined after a decadelong advance. However, over the long run, we’ve shown that real estate returns tend to fare well. Ideally, your investment portfolio should allocate between 5% and 20% to real estate, but the best avenue for reaching that exposure depends on your situation.

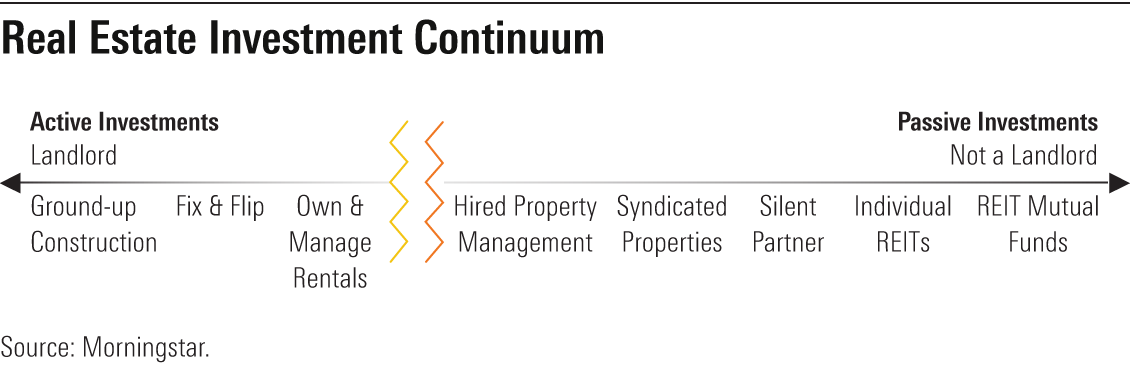

Below, we showcase a continuum of real estate investments by the degree of personal involvement and responsibilities. And here, we break down the benefits and drawbacks of each.

Pros and Cons of Investing in REITs

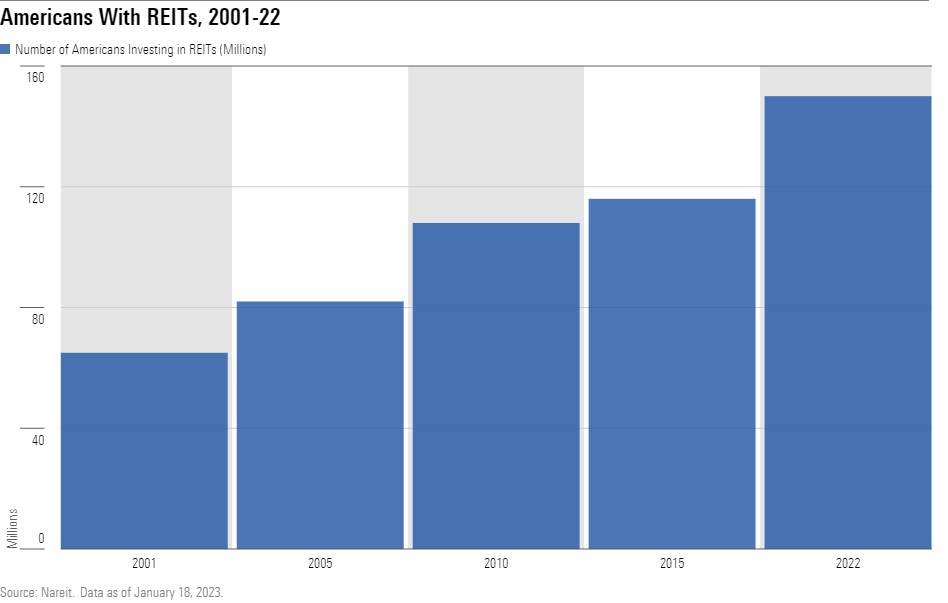

More than 45% of American households own REITs, nearly double the estimate from two decades ago. They can be a good fit if you want the diversification benefits of real estate without the commitment and responsibilities of directly owning property.

REITs can be a good choice because:

- Buying and selling REIT shares is easier than it is with a physical property.

- They obviate the need for market-specific knowledge and property management while making it easier to diversify your real estate portfolio. Instead of owning one concentrated position, you own a fraction of tens, hundreds, or thousands.

- They won’t require you to start a mortgage on an investment property and make investing in out-of-state real estate easier.

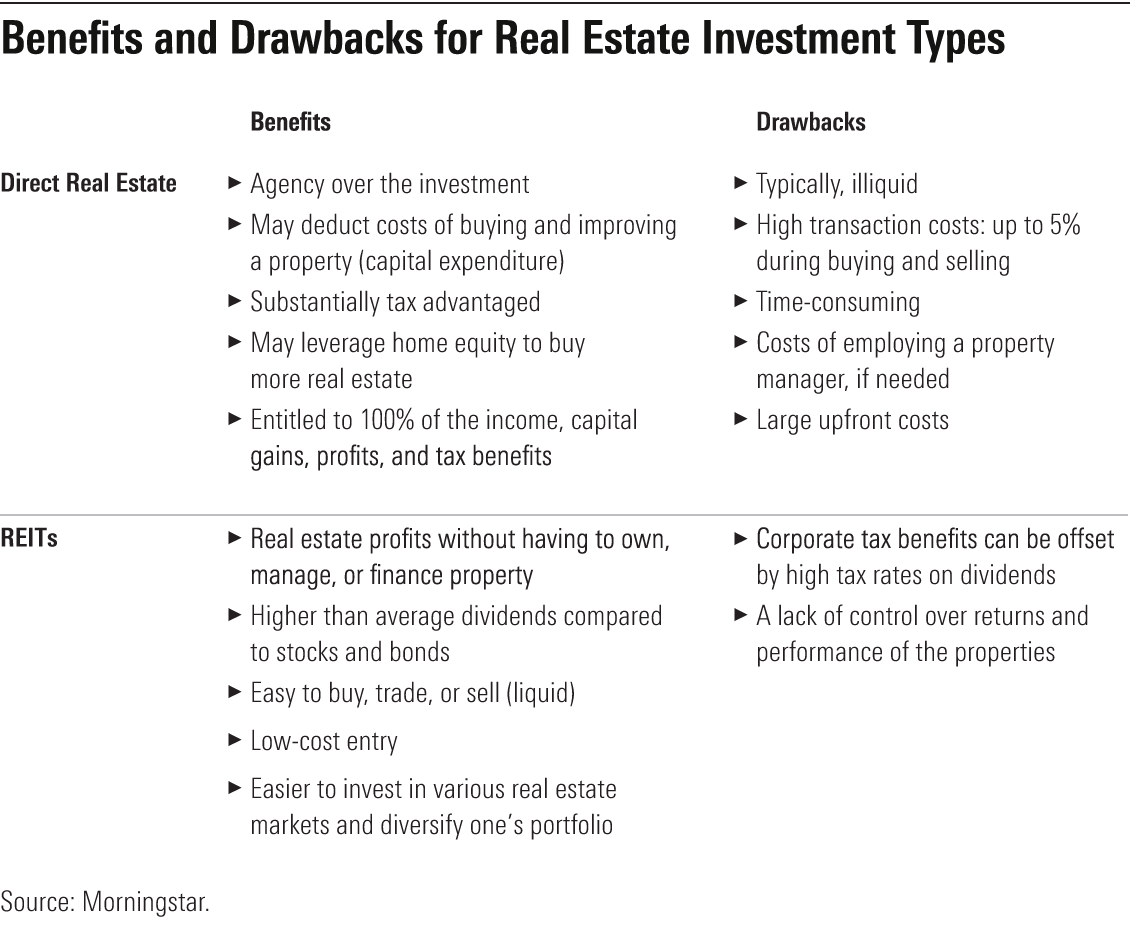

Finally, the issue of taxes. REITs enjoy favorable corporate tax treatment, avoiding them entirely if they pass along an adequate share of earnings directly to investors.

However, this typically means REITs have large dividend yields, and dividends are unfavorably taxed relative to capital gains for high-income investors. For those in higher tax brackets, this could be unpalatable. In contrast, direct real estate ownership provides exceptional tax benefits if managed carefully.

Pros and Cons of Investing Directly in Real Estate

On the other hand, if you prioritize agency in an asset by limiting intermediaries, then directly purchasing a property could be right for you.

Substantial tax benefits can be associated with owning, managing, or “flipping” a property. Depending on how actively involved you want to be, you may be granted additional tax breaks for passive losses.

There’s also a wider range of potential outcomes, depending on your property’s type and location, relative to diversified REITs.

Directly investing in real estate can be financially rewarding, but it usually requires significant cash, due-diligence work, and time. Some may rely on a property manager, but this comes at the cost of profit margins. If you need cash, selling a property can take months and be costly, especially if you are not reinvesting the proceeds in another rental property.

With over 70% of rental properties in the United States owned by individual investors, not companies, this investment strategy may be appropriate if you have extra time and cash.

Should I Invest in Real Estate Directly or Indirectly?

Unraveling the nuances of the housing market can be confusing. Below, we leverage different personas to guide investors toward the right choice.

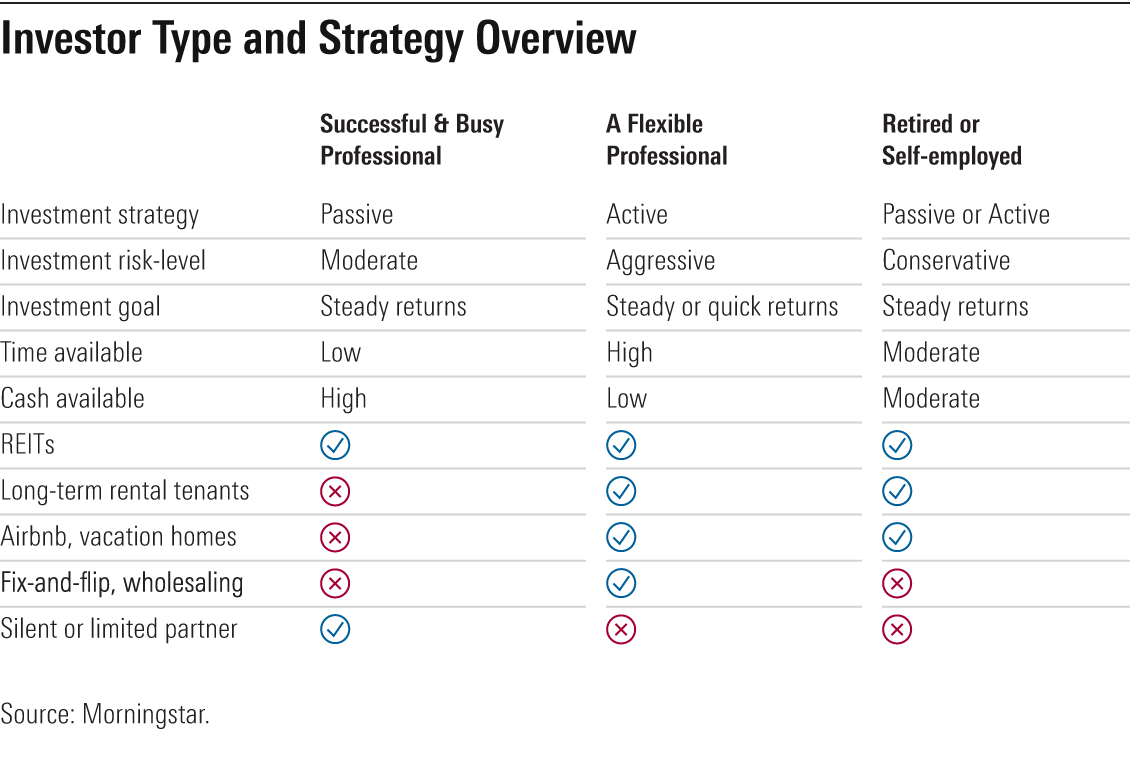

A successful and busy professional: Property ownership could be costly or infeasible if you don’t have time to deal with tenants or maintenance, so passively investing is likely the right choice, as REITs minimize time and effort while improving risk-adjusted returns in a mixed-asset portfolio.

Sophisticated or wealthy investors could consider becoming a silent partner to an active investor, which could generate higher returns but comes with substantial risk.

A flexible professional: Early careerists or those with flexible jobs may consider making real estate into a part-time job or hobby. Risk appetite, liquidity needs, and your willingness to earn sweat equity will inform the appropriate choice.

Purchasing a rental property could make sense if you’ve already built a traditional investment nest egg and have excess savings. Your spare time and capital can be invested into a specific asset in the right market, and you can leverage real estate’s tax treatment to boost your aftertax returns. Choosing tenants and working with maintenance providers is the time cost of actively investing in real estate.

Active investors have a wide range of opportunities to pursue. For example, if an investor has an appetite for remodeling, a fixer-upper could be an option. Between the tax benefits and leveraged nature of housing, this approach can compound returns quickly.

However, purchasing an illiquid asset could be a costly mistake if you don’t have an adequate financial cushion or suddenly need cash. On the other hand, buying shares of a diversified REIT at the right price could provide the diversification benefits you’re looking for without limiting portfolio liquidity.

Retired or self-employed: Professionals planning for retirement or without guaranteed income may lean toward real estate for steady income. Depending on the investor’s willingness to get hands-on, either a traditional investment or a REIT may be appropriate.

Empty nesters who plan to downsize or those who want to relocate may benefit from turning their current home into a rental property, especially if property prices are soft. If you purchase a home with a low interest rate and transition it into a rental, your investment property retains this perk and increases your positive cash flow. In addition, since a rental property is not treated as earned income, it is exempt from self-employment tax, or FICA tax. If time is a factor, then hiring a property manager for day-to-day decision-making could be right for you but will offset returns and may still take some of your time.

Shifting your investment strategy to REITs might be appropriate if free time is important to you but you desire a steady income. Perhaps you already have a passive income stream or a sizable investment portfolio. Taking advantage of diversified REITs is a strong choice for keeping your real estate assets liquid and easily investing in properties in various markets.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)